Reviewing 2025 in Singapore: Layoffs and closures in a GE year amid a changing job market

Here is a look at the developments that have shaped Singapore’s economic and business landscape in 2025 2025 was a year of disruption, adaptation, and resilience for Singapore. From AI-driven shifts in the workforce to closures in F&B, retail, and cultural spaces, businesses and consumers alike faced unprecedented challenges. Yet amid uncertainty, strategic government interventions […]

Here is a look at the developments that have shaped Singapore’s economic and business landscape in 2025

2025 was a year of disruption, adaptation, and resilience for Singapore.

From AI-driven shifts in the workforce to closures in F&B, retail, and cultural spaces, businesses and consumers alike faced unprecedented challenges.

Yet amid uncertainty, strategic government interventions and adaptive enterprises showed that the city-state could navigate change while staying ahead of the curve.

Hre’s a snapshot of the developments that shaped the economic and business landscape—and how Singaporeans stayed resilient in an increasingly cautious, uncertain climate.

Economic resilience amid global headwinds

The 2025 General Election (GE 2025) reaffirmed PAP leadership, providing much-needed policy continuity and business confidence at a time when political volatility was weighing on economies worldwide.

Key election concerns—cost of living, competitiveness, and workforce readiness—signalled the government’s continued commitment to supporting economic growth and nurturing talent.

For startups and SMEs, the GE outcome represented a “steady hands” approach, ensuring that long-term initiatives such as AI subsidies and the SkillsFuture roadmap remained on course.

Singapore also had to navigate a complex global environment. US–China tensions and the US tariffs prompted the formation of the Singapore Economic Resilience Taskforce (SERT), which aims to help local businesses weather external shocks. At the same time, deeper ASEAN multilateral engagement strengthened regional economic integration, reinforcing Singapore’s position in an increasingly fragmented, multipolar world.

Despite slower global growth and higher interest rates, Singapore’s economy remained resilient, posting an average year-on-year growth of 4.3% in the first three quarters.

A job market reshape

Yet as Vulcan Post observed, economic growth did not necessarily translate into job security.

Layoffs and slower hiring became defining themes of the year. According to MTI data, around 20,000 jobs were lost in Singapore in 2025, with sectors such as real estate, information and communications, and professional services, among the hardest hit.

Big tech also continued layoffs, with Microsoft, Meta, and TikTok shedding employees not just in Singapore but also globally.

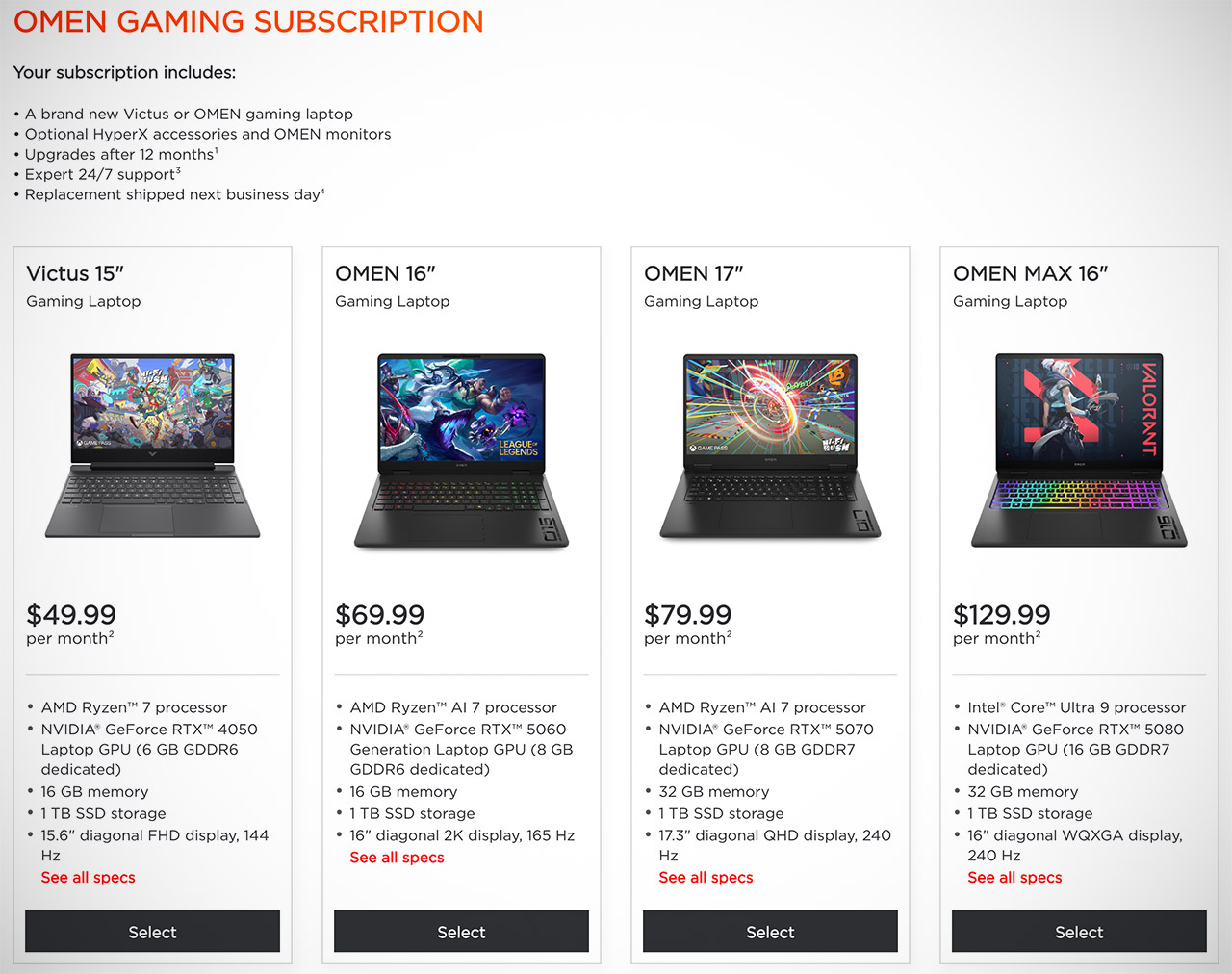

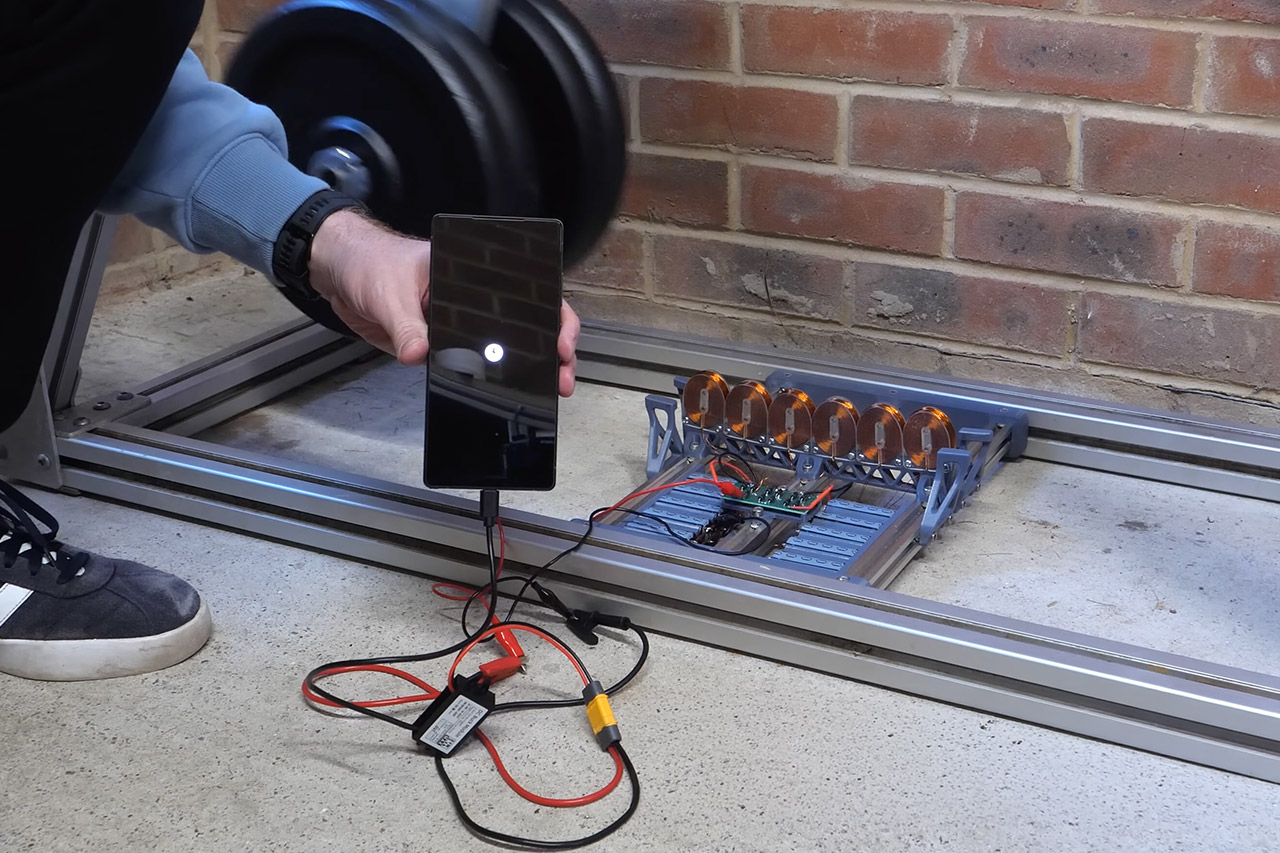

AI-driven shifts in the workforce have prompted many companies to restructure or slow hiring, often citing operational efficiency from automation.

However, the labour market in 2025 was being reshaped rather than hollowed out. Amid these job cuts, demand surged for roles in cybersecurity, AI, and digital infrastructure, signalling structural shifts in the economy rather than a simple cyclical downturn.

Simultaneously, flexible and contract work gained traction as alternative employment models, with gig platforms like Quest reflecting a growing willingness among workers to embrace non-traditional roles in pursuit of stability and opportunity.

This comes amid a growing “expectation gap” between workers and employers: 80% of employees have experienced mismatched expectations, often around pay, job scope, or workplace culture, driving burnout, quiet quitting, and growing distrust in organisations.

To help Singaporeans adapt to changes in the employment landscape, the government has made significant investments in workforce resilience and business transformation, as announced in Budget 2025.

Over S$400 million was allocated to the Enterprise Workforce Transformation Package, consolidating multiple support schemes and offering up to 70% funding for job redesign and skills development for SMEs.

Moreover, the new SkillsFuture Jobseeker Support scheme provides temporary income support for retrenched workers, helping them upskill and transition into new roles.

Inclusive employment was also prioritised, with wage offsets to encourage companies to hire seniors, ex‑offenders, and persons with disabilities.

Business survival in a shifting economy

Despite these measures, the business environment in 2025 remained challenging, as companies grappled with rising costs, manpower constraints, and cautious consumer spending.

These hurdles hit F&B businesses hardest—sectors already operating on thin margins, with the ‘lucky’ ones only making 5 to 7% profits, even before AI and global uncertainty entered the picture. Some businesses simply couldn’t keep up, even with technology.

The Ministry of Trade and Industry reported that the first 10 months of 2025 saw 2,431 F&B closures. More than 60% of these closed businesses were registered for five years or fewer, of which 82% never recorded a profit.

Yet some legacy brands, such as Lim Chee Guan and Tong Heng, have endured for decades by weathering epidemics, economic downturns, and shifting consumer tastes.

By modernising their aesthetics, improving efficiency beyond traditional methods, and expanding carefully with a clear understanding of market demand, these businesses have managed to stay relevant—retaining loyal older customers while winning over a younger generation.

Beyond F&B, cinemas have also been hit hard and have yet to fully recover from the COVID-19 downturn. The Projector, the independent cinema beloved for its eclectic screenings and arts programming, announced the closure of its long-standing Golden Mile Tower location, citing an “increasingly unforgiving” operating environment. Rising costs, shifting audience habits, and limited resources for arts-sector ventures made sustaining the space untenable, despite the cinema’s loyal following.

The wave of closures has also extended to digital-first businesses. Even without the burden of physical retail operating costs, online platforms such as Style Theory, a Singapore-based clothing rental service, struggled to stay afloat, with its owners citing the challenging economic climate as a key factor in the decision to wind down operations.

Amid this challenging environment, some businesses are choosing to press ahead rather than give up.

Gong Cha, for instance, shuttered all its outlets in response to a market where consumers were increasingly price-conscious, selective, and willing to switch brands—but it intends to come back stronger and relaunch its stores with revamped designs, refreshed branding, and more experience-focused offerings next year.

Ushering in 2026

Looking ahead to 2026, Singapore’s economic picture appears less bleak than the turbulence of 2025 might suggest.

Nearly one-third of firms are planning to increase their headcount in the first quarter, and hiring sentiment remains positive. With rising wages and steady GDP growth on the horizon, the year ahead offers a chance for businesses and workers alike to adapt, seize opportunities, and turn resilience into renewed growth.

- Read more stories we’ve written on Singaporean businesses here.

Also Read: 2024 in focus: Here’s our recap of events & business trends that made waves in Singapore

Featured Image Credit: Shadow_of_light/ depositphotos/ IM Imagery via Shutterstock/ DollarsAndSense/ Rawpixel via Shutterstock

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0